State Senate considering imposing high density rules in all Oregon cities.

SB 10 would force cities over 10,000 to allow ultra-high-density development within a half mile of any priority transportation corridor. This would override all current zoning in the entire JWN and allow up 75 units per acre (43560 sf) with no requirements to provide parking. Currently, the JWN special area zones allow up to 18 units per acre. Further, any height required to achieve this level of density must be allowed. For example, a 6000 sf lot could have about 10 units and could potentially be 3+ stories. Obviously, this would greatly burden existing infrastructure, cut off air and sunlight, and result in the removal of numerous trees. There is no requirement that any built units be affordable in the technical or practical sense. In fact, the can’t be, it doesn’t pencil out.

Read Mayor Vinis’ Opposition to SB 10 Testimony

The JWN opposes this and similar bills on both conceptual and practical grounds.

Local Control

First, the state stepping into local zoning rules intrudes on a cities’ sovereignty and the ability of citizens and their elected officials to make decisions that reflect the will of the people that directly impact their lives and property. It is also a clear violation of State Planning Goal 1 which requires public input in every stage of the planning process. How can anyone besides special interest groups and developers participate in, let alone influence, what goes on in Salem? These moves by the legislature are deeply anti-democratic.

Second, the rationale that such a move would increase the stock of affordable housing is not supported by any evidence – literally no supporting documentation was provided with SB 10. However, there is ample evidence that such radical upzoning causes gentrification while having no impact on housing affordability. Creating housing in one price segment has little impact on other price segments. consider the recent report on the experience of Vancouver, WA:

https://www.columbian.com/news/2018/nov/19/vancouver-reviews-status-of-affordable-housing/

“‘But as the council pointed out, the city can’t build its way out of the affordable housing crisis.’ Councilor Bart Hansen said when the city first began really taking a look at affordable housing a few years ago, the party line was if you build more units, prices will go down. Essentially, Hansen said, supply and demand would fix the problem. ‘What we’re seeing now is the availability is going up and the price is not going down,’ he said. Further, “’People are struggling with paying their rent every day’ said Peggy Sheehan, the city’s community and economic development programs manager. ‘There has been some trickle down that’s rumored to happen, but we aren’t seeing it.'”

In a research study on transit upzoning in Chicago published in CityLab (MIT), the author Yonah Freemark reaches “two startling conclusions that, interestingly enough, he has said he did not set out to find. First, he found no effect from zoning changes on housing supply—that is, on the construction of newly permitted units over five years.” This is very much at odds with the conventional wisdom that is driving SB 10. “Second, instead of falling prices, his study found the opposite – housing prices rose on the parcels and in projects that were upzoned, notably those where building sizes increased.”

Urban Infill Cannot Create Affordable Housing without Subsidy

The problem lies in the cost of built urban infill housing, demolition, and construction combined with how development is financed.

Base Line Stats

The average household income of a Eugene resident is $26,313 a year – 30% for housing is $650 a month.

The median household income of a Eugene resident is $42,715 a year – 30% for housing is $1075 a month.

Costs of construction for 1000 sf unit (excluding land and development fees)

200K for 1000 sf @$200 per sf

175K for 1000 sf @$175 per sf

One bedroom apartments in Eugene rent for $996 a month on average and two bedroom apartments rents average $1278.

This means that a family making the average income is typical spending a lot more than 30%, those who made the median income are closer to the 30% depending on the number of people in their household.

The problem is that urban infill is constrained by certain stranded costs that makes it highly unlikely it can provide affordable (in spending 30% or less) housing.

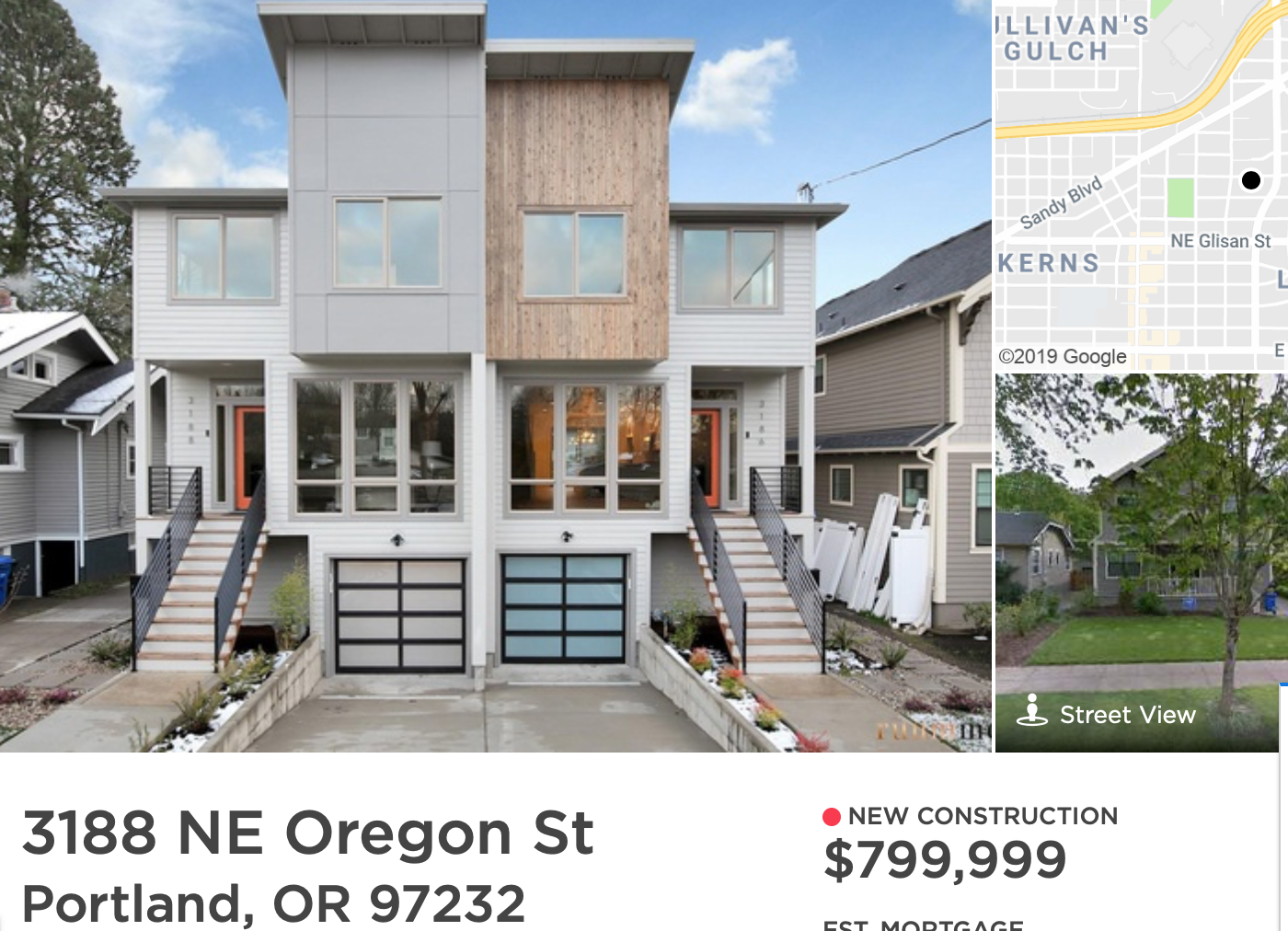

As a quick back-of-the envelope calculation, for example, let’s look at a four-plex infill development in the JWN. Keep in mind that this level of density is currently allowed in our SAZs with some set-back and slope restrictions. Since we are built-out, lots already contain houses situated for a single home lot. Currently, the starting price for a house in the JWN is about $300k. So, first that house has to be purchased and demolished (about $15k). Let’s say the proposed four-flex units are 1000 sf each – about 10% of a building like this is “wasted” non-residential space (hallways, stairs, etc.), so add at least $70k on top. That means that for the typical construction costs (including profit) is between $175 and $200 a sf (excludes any non-habitable development cost such as storage, hardscape, or landscaping). Therefore, the building costs are between $175k and $200k per unit or $700k to $800k for the four-flex. Add to that the cost of land ($300k) and development charges ($20k) and that wasted common space and your four-plex project is now at 1.2 million+.

The JWN is 65% renters and many live in marginal rental houses. Because these are the most affordable, our fear is that these rentals will be the first to be redeveloped and result in a net loss of affordable rentals. Therefore, we will get the worst of both worlds, degraded livability, the destruction of older historic homes, lost mature trees, and gentrification. SB 10 is great way to chase renters out of the urban core.

What About an Owner-Occupied Duplex?

In another scenario, the property could be developed as a duplex, each for sale as owner occupied.Keep in mind that in a vast majority of the JWN, this sort of construction is currently allowed with some restrictions on setback and slope.

At 1500 sf each that would place the cost of construction (@$150 per sf) at $225k, plus the $300k for the lot, 15k for demo, 30k for development fees and you get $400k EACH. While this would help fill out the $350-$500k low inventory segment, it is way out range for the vast majority of residents, since you would need to have an income twice the median to afford it. Bottom line is that built-out urban land is expensive and desirable neighborhood like the JWN are even more so. Look around, as developers can get the financing, this type of development is cropping up. This does not serve the people who already live here.

6th and 7th Street Corridors

Finally, there is the fact that the land on 6th and 7th is already zoned for high density and buildings can be as tall as 120 feet!. Downtown and the EMX is right there. Notice any big apartment buildings or or condos going up? No? That is because the investment would be massive and developers do no see the risk as worth the cost. Seems like a great place for subsidized affordable housing, we have been asking for it for years.

If we thought any of this would make housing more affordable we would be supportive. But all SB 10 does is steal agency from communities and leave them at the mercy of developers. It completely ignores the unique conditions on the ground and fails to take advantage of opportunity siting for higher density in neighborhoods. SB 10 will make a few people a lot of money on the backs of the many who can’t afford it.

Urban neighborhoods like the JWN have been ignored, dis-invested, seen tough times, and fought their way back to viability due to the hard work and dedication of residents and now that we are hip, trendy, and in demand they want to hand it over to gentrifiers looking to make a quick buck. SB 10 has nothing to do with affordable housing and everything to do with greed. Don’t buy the lie.